Helping You Grow Wealth Through Real Estate

Helping You Grow Wealth Through Real Estate

1099 = the IRS 1099 statement of "other income." For example, self-employed people do not receive a yearly W2 statement of earnings from an employer, but they might receive a 1099 from firms who have paid them wages, commissions or fees.

ARM = Adjustable rate mortage. A mortgage where the interest rate can change. For example, your loan has a fixed rate for 5 years and after the rate will adjust up or down to the current market rate. There are pros and cons to these type of loans — call us to discuss it. With a "fixed-rate mortgage", on the other hand, the rate never changes.

Closing costs = The expenses incurred when buying a property and when obtaining a loan, such as taxes, title insurance, appraisal fee, notary fee, etc. This does not refer to your down payment (that is separate).

Down payment = the portion of the purchase price you pay from your pocket. For example, if you financed 90% of the purchase price, you would pay the remaining 10%, your down payment.

DTI = debt-to-income. The ratio of your debt to your income. The equation is: your total debts (credit cards, car payments, mortgage, etc) divided by your gross income.

FICO = your credit score. "FICO" is a brand name for the scoring system used by just one of the credit bureaus, but many people refer generically to their score as FICO.

Fully amortized = A payment that includes both interest and principal so that at the end of the loan the balance is zero (yea!). In other words, you are paying the interest due on the money borrowed, and you’re paying down the loan amount. Alternatives to this are interest-only loans (see "I/O" in this glossary) and negative amortization loans (see "neg am" in this glossary).

Full doc = a "full documentation" loan, where you provide documents showing your income, assets, etc. See also "limited doc" and "no doc".

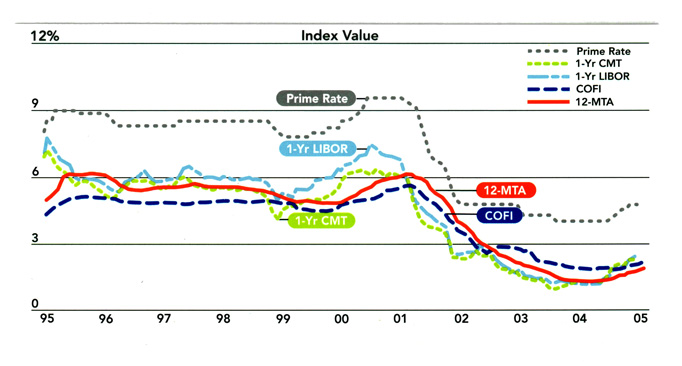

Index = An index is a economic indicator. You’re probably familiar with the "Dow Jones Industrials" or "S&P 500" indexes quoted on the nightly news (those indexes measure stock market performance). The interest rate for some loans are based on indexes such as MTA, LIBOR, COFI, CODI, etc. As the value of the index changes, so do mortgage rates. This chart shows various indexes:

Interest-only or I/O = A loan where you have the option to pay only the interest due each month, instead of the fully-amortized payment of interest and principal. The advantage to this type of loan is that the payments are lower than the payments on a fully-amortized payment. At some point, of course, you are required to begin making payments to pay down the principal, too. Alternatives to this type of loan are "fully amortized" and "negative amortization" and those are also described in this glossary.

LIBOR = London Inter-bank Offered Rate. The interest rate banks charge other banks for borrowing money. Some mortgage interest rates are set according to this index. See also MTA.

Limited doc = a "limited documentation" loan, where you provide less documentation of your financial status. For example, instead of providing two-year’s worth of income documents, you provide your bank statements for the last 6 months. See also "full doc" and "no doc".

LTV = Loan-to-value. The ratio of the loan amount to the property value, in other words, the loan amount divided by the value of the property. For example, an 80% LTV means you are obtaining a loan equal to 80% of the property value.

Mortgage Insurance or MI = see "Private Mortgage Insurance".

MTA or MAT or 12-MTA = Moving Average Treasury index. This index is based on the average prices of U.S. Treasury Securities sold by the US government. Some loan rates are tied to this index.

Neg am = see "Negative Amortization"

Negative amortization = A loan payment that is less than the full amount of interest due. In this type of loan, the lender allows you to make payments that are less than the interest-only payment, meaning the amount of your loan actually increases each month. These loans are popular with investors who expect the value of their property to increase. The advantage to this type of loan is that your payments are as low as possible. There are disadvantages, too, so call us to discuss it. Alternatives to this type of loan are "fully amortizing" and "interest-only" — those are also described in this glossary.

No doc = a "no documentation" loan, where you do not state your income or assets nor do you provide any documents to prove it. We have lenders who will qualify you based only on your credit score and your equity in the property, not based on income. See also "full doc" and "limited doc".

Owner occupied or O/O = The property is occupied by the owner, not by a tenant nor used as a vacation home. A loan for an owner-occupied has less risk for the lender, so the interest rate is less than for investment or vacation homes. An O/O loan typically requires that you live in the property for at least one year and after that you may rent it out if you wish.

Private mortgage insurance or PMI = Insurance you buy to protect the lender in case of default. MI is usually required if you obtain a loan for more than 80% of the property value. We have techniques for avoiding PMI.

PUD = Planned unit development. A planned development, such as townhomes.

Stated = you say how much you earn, or how much you have in assets, but you don’t provide any documentation to prove it. The lender will compare your stated income to the type of work you do and it has to be reasonable.

SFR = single family residence. A house for a single family (detached or attached to another), but not a condo or townhome.

VOE = verification of employment. The lender contacts your employer to confirm that you are employed and the amount of your wages or salary.

VOM = verification of mortgage. The lender contacts your bank to confirm that amount of your monthly mortgage payment and whether or not you have been late on any payments.

VOR = verification of rent. A short questionnaire sent to your landlord asking them to confirm that amount of rent you’ve been paying and whether or not you have been late on any payments.

Direct: (408) 723-5200,